Aerial view of a modern European cityscape with commercial and residential buildings illustrating real estate development

European real estate markets are experiencing a remarkable transformation in 2025, presenting investors with unprecedented opportunities across diverse urban landscapes. From high-yield emerging markets in Eastern Europe to stable, luxury-focused Western capitals, this comprehensive guide reveals the top destinations where your investment capital can generate exceptional returns while building long-term wealth.

Market Analysis: Prime European Investment Hotspots Driving Capital Growth

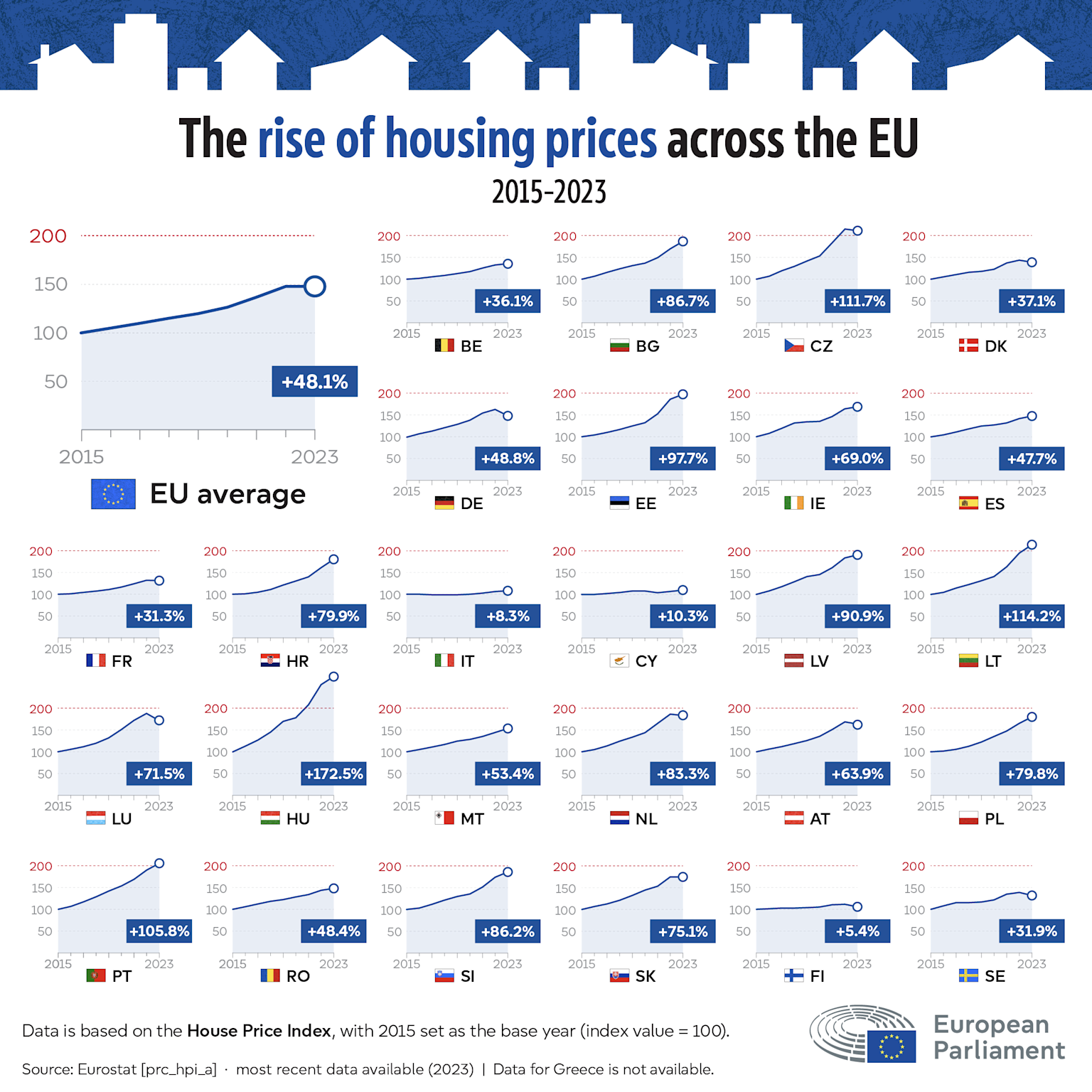

Infographic showing housing price increases across EU countries from 2015 to 2023 based on the Eurostat House Price Index

The European property landscape has evolved significantly, with traditional markets like London and Paris now joined by dynamic emerging cities offering superior rental yields and capital appreciation potential. Investment flows have increasingly shifted toward markets providing the optimal balance of stability, growth, and affordability.

Eastern European Powerhouses Leading Yield Performance

Construction cranes at a multi-story urban development site with a completed high-rise in the background

Eastern European cities are commanding unprecedented attention from international investors, delivering rental yields that often exceed 6-8% annually while maintaining strong growth trajectories. These markets benefit from EU membership stability, growing economies, and significantly lower entry costs compared to Western counterparts.

Western European Capitals Maintaining Premium Appeal

Despite higher entry costs, established markets like Madrid, Berlin, and Amsterdam continue attracting substantial capital due to their economic stability, international connectivity, and consistent long-term appreciation. These cities offer lower yields but provide superior capital preservation and international liquidity.

Riga: The Baltic Investment Champion with Exceptional Returns

Historic buildings in Riga Old Town showcase the architectural heritage of Latvia’s capital

Riga leads European rental yield rankings with an impressive 8.47% average return, making it the continent’s most profitable investment destination. Latvia’s capital combines UNESCO World Heritage charm with robust economic fundamentals, attracting investors seeking both lifestyle benefits and strong financial performance.

The city’s steady development in infrastructure, hospitality, and business sectors has created sustainable demand for quality rental properties. Property prices average €852-853 per square meter, offering exceptional value compared to Western European alternatives while maintaining strong appreciation potential of 3-7% annually.

Investment Advantages:

- Exceptional rental yields of 8.47% significantly outperforming European averages

- Affordable entry point with properties under €200,000 readily available

- EU membership stability providing legal security for international investors

- Growing tourism and business sectors supporting rental demand

- Infrastructure improvements including Rail Baltica connections enhancing long-term value

Dublin: Irish Capital Delivering Consistent High-Yield Returns

Dublin’s property market demonstrates remarkable resilience with rental yields ranging from 6.83% to 7.96%, driven by acute housing shortages and sustained economic growth. The city’s status as a European tech hub and financial services center creates consistent demand for quality accommodation.

Average property prices have surged 99% over the past decade, with continued appreciation supported by limited supply and strong demographic trends. The rental market particularly favors investors, with properties typically securing tenants within days due to chronic undersupply.

Key Investment Metrics:

Price appreciation: 28.4% over five years with continued growth expected

Rental demand: Properties rent within 24-48 hours due to limited supply

International appeal: No restrictions on foreign ownership

Economic stability: 4% GDP growth forecast supporting market fundamentals

Bucharest: Romania’s Capital Offering Exceptional Value and Growth

Bucharest presents compelling investment opportunities with rental yields reaching 6-7% in premium areas while maintaining affordable entry costs. The Romanian capital experienced dramatic price growth of 15-22% in 2024, establishing it as one of Europe’s fastest-appreciating markets.

Property prices average €1,862 per square meter citywide, ranging from under €100,000 in outer districts to €300,000+ for premium locations. The city’s growing expat community and returning Romanian diaspora create sustained rental demand across all property segments.

Market Highlights:

- High rental yields: 6-7% in prime locations like Floreasca and Pipera

- Affordable pricing: Properties available from under €100,000

- Strong growth: 15-22% price appreciation in 2024

- International demand: Growing expat and business community

- Infrastructure development: Major improvements enhancing property values

Brussels: European Capital Providing Stability and Institutional Demand

Modern office buildings and a broad boulevard in Brussels’ European Quarter, showcasing contemporary architecture and urban design

Brussels offers stable investment returns with rental yields around 4-4.2%, supported by consistent demand from EU institutions, international organizations, and multinational corporations. The Belgian capital’s role as Europe’s political center creates reliable, long-term rental demand from diplomatic and business communities.

Property prices average €3,408 per square meter for apartments, positioning Brussels as more affordable than Paris or London while offering superior stability and liquidity. Areas like Ixelles and the European Quarter command premium rents due to proximity to major institutions.

Investment Benefits:

- Stable yields: 4-4.2% supported by institutional demand

- International tenant base: EU staff and multinational employees

- No ownership restrictions: Full property rights for foreign investors

- Established market: Transparent legal framework and efficient transactions

- Central location: Excellent connectivity to major European cities

Madrid: Spain’s Capital Leading European Investment Preferences

Twilight view of luxury residential and commercial buildings on Madrid’s Gran Via with dynamic city traffic and illuminated architecture

Madrid has ascended to become Europe’s preferred investment destination, capturing 69% of European investor preferences according to recent surveys. The Spanish capital combines strong economic fundamentals with attractive rental yields and significant infrastructure investment.

Property prices average €4,290 per square meter citywide, with continued growth of 5-7% annually expected. The luxury market performs particularly well, with neighborhoods like Salamanca and Chamberí experiencing 20-25% price increases.

Key Advantages:

- Top investor preference: Leading European destination for 2025

- Strong yields: 3-4% in prime areas, up to 5.5% in emerging neighborhoods

- Major infrastructure: €25 billion Madrid Nuevo Norte development

- International appeal: 72% of Spain’s foreign investment flows

- Favorable taxation: Attractive rates for international investors

Lisbon: Portuguese Capital Combining Growth with Golden Visa Benefits

A modern residential building in Lisbon with green balconies and rooftop gardens highlighting sustainable urban living

Lisbon’s property market offers compelling rental yields of 4.96% nationally, with the Greater Lisbon Area achieving 6.8% according to industry data. The Portuguese capital benefits from significant infrastructure development, growing tech sector presence, and attractive residency programs for investors.

Property prices have experienced 57% growth in the second quarter compared to previous periods, with continued appreciation expected as demand from digital nomads and international businesses increases. The city’s combination of cultural appeal, favorable climate, and EU access creates sustained investment demand.

Market Strengths:

- Attractive yields: 4.96% with potential for higher returns in prime areas

- Strong appreciation: 57% price growth demonstrating market momentum

- Infrastructure investment: Major metro and waterfront redevelopment projects

- International appeal: Growing tech hub attracting global talent

- Residency benefits: Non-Habitual Resident tax advantages

Berlin: German Capital Offering Luxury Opportunities and Tech Hub Benefits

Outdoor patio area with a wooden table and chairs in a luxury Berlin Mitte apartment building surrounded by greenery

Berlin’s luxury property market commands €8,500-12,000 per square meter in prime neighborhoods like Mitte, Charlottenburg, and Grunewald. As a major European tech hub, the city attracts affluent professionals creating sustained demand for high-quality residential properties.

The German capital benefits from steady rental demand and strong long-term capital appreciation potential, positioning it as significantly more affordable than London or Paris while maintaining cultural significance and economic importance.

Investment Appeal:

- Luxury market leader: €8,500-12,000/m² in prime locations

- Tech hub status: Attracting high-earning professionals

- International appeal: 30-40% lower prices than comparable European capitals

- Strong fundamentals: Steady appreciation and rental demand

- Cultural significance: World-class institutions and lifestyle amenities

Paris: French Capital Maintaining Premium Market Position

Haussmannian apartment building in Paris featuring classic mansard roof and wrought iron balconies

Paris demonstrates rental yields of 4.72% citywide with significant variation by district. The French capital ranks as the fourth most sought-after destination for ultra-high-net-worth individuals, maintaining its position as a premier global real estate market.

Average property prices reach €10,700 per square meter, with studios commanding exceptional yields of 12.82% due to strong tourist and student demand. The city’s ongoing Grand Paris development project continues driving long-term value appreciation.

Premium Market Features:

- Stable yields: 4.72% average with higher returns in select areas

- Ultra-luxury appeal: Fourth-ranked destination for wealthy investors

- Major development: Grand Paris project enhancing connectivity

- Tourist demand: Strong short-term rental potential

- Cultural premium: Unmatched global recognition and appeal

Milan: Italian Fashion Capital Delivering Strong Returns

Milan tops European real estate investment rankings with €13 billion planned investment between 2019-2029. The Italian fashion and finance capital offers rental yields of 7.04% nationally with prime central locations commanding premium pricing.

Property prices average €5,500 per square meter citywide, ranging from €3,000-4,000 in outer districts to over €10,900 in the historic center. The city’s status as a global fashion and design hub creates consistent international demand.

Investment Highlights:

- Investment leader: €13 billion planned development

- Strong yields: 7.04% with premium location potential

- Global appeal: Fashion, design, and finance hub

- Price range: Diverse options from €3,000-10,900/m²

- International demand: Consistent luxury market performance

London: Global Financial Capital Maintaining Investment Dominance

London retains its position as Europe’s top city in thematic investment rankings despite higher entry costs. The British capital continues attracting 93% preference from non-European investors, the highest among all European locations.

While rental yields are lower at approximately 3-4%, London offers superior liquidity, international appeal, and long-term capital preservation benefits that justify premium pricing for many investors.

Global Appeal:

- Investment preference: 93% from non-European investors

- Liquidity leader: Most liquid European property market

- International gateway: Unmatched global connectivity

- Capital preservation: Strong long-term wealth protection

- Premium positioning: Continued ultra-luxury market leadership

Amsterdam: Dutch Capital Balancing Yields with Stability

Amsterdam ranks second in European thematic city rankings, offering investors a combination of strong economic fundamentals and reasonable returns. The Dutch capital provides stability and growth potential while maintaining more accessible pricing than London or Paris.

The city’s strong networks and cosmopolitan appeal create sustained rental demand from international professionals, students, and tech workers. Investment opportunities span from historic canal properties to modern developments serving the growing business community.

Copenhagen: Danish Capital Providing Sustainable Investment Returns

Copenhagen ranks fifth in European investment appeal with strong performance across multiple investment criteria. The Danish capital offers stable returns supported by sustainable development initiatives and strong economic fundamentals.

Recent data shows 9.6% quarterly price growth, indicating strong market momentum. The city’s focus on sustainability and quality of life creates long-term investment appeal for environmentally conscious investors seeking stable returns.

Zurich: Swiss Financial Hub Offering Premium Stability

Zurich commands €13,870 per square meter average pricing, positioning it among Europe’s most expensive markets while offering exceptional stability. The Swiss financial capital provides 2.70% prime yields with unmatched economic security and currency stability.

Despite lower yields, Zurich attracts investors seeking capital preservation and long-term wealth protection in one of the world’s most stable political and economic environments.

Premium Positioning:

- Price leadership: €13,870/m² reflecting premium quality

- Stability focus: 2.70% yields with exceptional security

- Financial hub: Global banking and finance center

- Currency benefits: Swiss franc strength and stability

- Quality of life: Consistently top-rated livability

Vienna: Austrian Capital Delivering Balanced Investment Returns

Vienna offers rental yields of 4.12% for residential properties, providing attractive returns while maintaining the stability associated with Austrian markets. The capital’s combination of cultural heritage, economic stability, and reasonable pricing creates sustained investment appeal.

Property markets show balanced performance with selective opportunities in districts offering higher yields while maintaining the quality and stability expected in Austrian real estate.

Stockholm: Scandinavian Leader with Premium Appeal

Stockholm maintains prime yields of 2.50%, reflecting the premium nature of Scandinavian real estate markets. Despite lower yields, the Swedish capital offers exceptional stability, strong economic fundamentals, and consistent long-term appreciation.

The city’s position as a major tech and innovation hub creates sustained demand for quality accommodation while maintaining the high living standards characteristic of Scandinavian markets.

Warsaw: Polish Capital Offering High-Yield Opportunities

Modern skyscrapers and apartment buildings in Warsaw, Poland, showcasing urban development and investment potential

Warsaw leads Polish investment opportunities with rental yields reaching 5.75% and strong economic fundamentals supporting continued growth. Poland’s capital benefits from its status as Central Europe’s major business hub and consistent economic expansion.

The city experienced significant price appreciation with properties increasing substantially over recent years while maintaining affordability compared to Western European alternatives.

Growth Fundamentals:

- Strong yields: 5.75% with growth potential

- Economic hub: Central Europe’s business center

- Affordable entry: Competitive pricing vs. Western Europe

- EU stability: Membership benefits and legal security

- Infrastructure development: Continued improvements supporting values

Kraków: Cultural Gem with Expanding Tech Sector

Kraków combines rich cultural heritage with a thriving economy driven by tourism, technology companies, and universities. The city ranks among Europe’s top investment destinations due to its balanced growth profile and affordable entry costs.

Prime yields reach 6.00% according to recent data, with continued growth supported by the city’s position as a major technology and business services hub.

Investment Benefits:

- High yields: 6.00% prime returns

- Tech growth: Major technology hub development

- Cultural appeal: UNESCO World Heritage tourism

- University presence: Consistent rental demand

- Value positioning: Affordable European cultural capital

Gdańsk: Baltic Coast Combining Maritime Charm with Business Growth

Gdańsk offers unique investment opportunities combining coastal appeal with expanding logistics and business sectors. The city’s thriving port, expanding logistics sector, and tourism popularity create diverse investment possibilities.

Investment opportunities include seaside apartments, vacation rentals, and commercial properties in logistics hubs, providing both long-term appreciation and seasonal rental income potential.

Wrocław: Poland’s Rising Tech Hub with Strong Fundamentals

Wrocław emerges as Poland’s tech capital with major global companies establishing operations and creating sustained demand for professional accommodation. Prime yields reach 6.00%, matching Kraków while offering emerging market upside potential.

The city’s combination of economic growth and lifestyle appeal makes it attractive for both domestic and international investment, with new-build apartments near business districts showing particular promise.

Sofia: Bulgaria’s Capital Providing Eastern European Value

Modern high-rise buildings and urban development in Sofia, Bulgaria, illustrating a contemporary property investment project

Sofia offers exceptional value with property prices starting from €52,000 for studio apartments while delivering rental yields of 5-7% annually. Bulgaria’s capital provides EU membership benefits at significantly lower entry costs than Western alternatives.

Recent price growth of 15-20% for property flips demonstrates strong market momentum, while continued development and infrastructure improvements support long-term appreciation.

Value Proposition:

- Affordable entry: Studios from €52,000

- Strong yields: 5-7% annual returns

- Price growth: 15-20% flip profits

- EU benefits: Membership security and stability

- Development momentum: Infrastructure improvements

Belgrade: Serbian Capital Offering High-Yield Opportunities

Belgrade provides exceptional rental yields averaging 8.25% with studio apartments reaching 10.65% returns. Serbia’s capital combines affordability with strong rental demand from growing expat communities.

Property prices remain highly accessible with studios from €56,350 and larger apartments under €250,000, while net yields typically reach 2.8-4% after all expenses.

High-Yield Features:

- Exceptional returns: 8.25% average yields

- Affordable pricing: Studios from €56,350

- Growing demand: Expanding expat community

- Regional hub: Balkan business center

- Value opportunity: Pre-EU membership pricing

Cluj-Napoca: Romania’s Silicon Valley with Tech-Driven Growth

Cluj-Napoca has evolved into Romania’s leading tech hub, often called “Romania’s Silicon Valley” due to its thriving startup ecosystem and multinational tech company presence. The city offers strong investment fundamentals driven by high-skilled job creation and population growth.

Major companies like Bosch, Emerson, and NTT Data have established significant operations, creating well-paying jobs that drive housing demand and support property values. Investment opportunities span modern apartments and office spaces serving the growing professional community.

Budapest: Hungarian Capital Balancing Yield with European Connectivity

Budapest offers attractive investment opportunities as the seventh most sought-after destination for ultra-high-net-worth individuals. The Hungarian capital provides access to European markets while maintaining competitive pricing and reasonable yields.

Recent market analysis shows steady rental demand supported by international business presence and tourism, while new government investment programs encourage foreign property investment.

Strategic Advantages:

- UHNW appeal: Seventh-ranked luxury destination

- European access: EU membership benefits

- Investment incentives: Government programs supporting foreign investment

- Tourism strength: Consistent short-term rental demand

- Competitive pricing: Lower costs than Western Europe

Valletta: Malta’s Capital Offering Mediterranean Luxury with EU Benefits

Valletta demonstrates steady market growth with 3-7% annual price increases forecast for 2025. Malta’s capital provides unique investment opportunities in a UNESCO World Heritage setting with full EU membership benefits.

Rental yields range from 2.9% to 6% depending on property type and location, with short-term rentals in prime areas achieving up to 8% returns. The market shows consistent foreign buyer interest and stable long-term appreciation.

Mediterranean Appeal:

- Heritage setting: UNESCO World Heritage capital

- Steady growth: 3-7% annual appreciation forecast

- Yield range: 2.9-6% with premium area potential

- EU benefits: Full membership advantages

- Foreign buyer friendly: Straightforward ownership process

Limassol: Cyprus Investment Hub with High-Value Opportunities

Spacious and modern living room interior of a luxury apartment with panoramic city views on the Mediterranean coast

Limassol leads Cyprus property investment with rental yields of 5.29% and strong international buyer presence. The city attracts substantial foreign investment, particularly from ultra-high-net-worth individuals seeking Mediterranean lifestyle combined with business opportunities.

Property prices reflect premium positioning with new apartments and houses commanding substantial premiums, while the city’s status as a financial services hub creates sustained rental demand.

Paphos: Cyprus Coastal Investment with Strong Appreciation

Paphos experiences exceptional price growth with houses rising 11.8% and apartments surging 14.4% year-on-year. The city attracts 83% foreign buyers, making it Cyprus’s most popular international investment destination.

Average prices range €2,500-3,500 per square meter with coastal properties exceeding €4,000, while continued infrastructure development supports long-term value appreciation.

Growth Leadership:

- Price appreciation: 11.8-14.4% annual growth

- Foreign domination: 83% international buyers

- Premium pricing: €2,500-4,000/m²

- Infrastructure development: Supporting long-term values

- Investment appeal: Leading Cyprus destination

Nicosia: Cyprus Capital Providing Balanced Investment Returns

Nicosia offers rental yields of 4.78% while serving as Cyprus’s political and administrative center. The capital provides more affordable entry points compared to coastal cities while maintaining stable rental demand from government, business, and diplomatic communities.

Market positioning reflects balanced opportunities between coastal luxury and inland value, with consistent demand supporting steady investment returns.

Investment Strategy Recommendations: Building Your European Portfolio

Construction site with cranes in an Eastern European city at dusk reflecting in a water body

Emerging Market Focus: Cities like Riga, Belgrade, and Sofia offer exceptional yields of 6-8%+ for investors prioritizing income generation and accepting moderate political risk.

Established Market Stability: Berlin, Madrid, and Amsterdam provide 3-5% yields with superior capital preservation and international liquidity for conservative investors.

Luxury Market Positioning: London, Zurich, and Paris offer 2-4% yields but exceptional long-term wealth preservation and international prestige.

Value Growth Opportunities: Bucharest, Cluj-Napoca, and Paphos demonstrate strong appreciation potential of 10-15%+ annually while maintaining reasonable entry costs.

Balanced Portfolio Approach: Combine high-yield Eastern European properties with stable Western European assets to optimize both income and capital preservation across economic cycles.

Modern luxury apartments with a waterfront view and family-friendly promenade in southern Malta

The European real estate investment landscape in 2025 offers unprecedented opportunities across diverse markets, price points, and risk profiles. Success requires careful market analysis, local expertise, and strategic positioning aligned with your investment goals and risk tolerance. Whether seeking high-yield income generation or long-term capital appreciation, these 30 cities provide the foundation for building substantial wealth through European property investment.

Key Takeaways:

- Eastern European cities lead in rental yields, often exceeding 6-8% annually

- Established Western markets provide stability and liquidity with 3-5% yields

- Infrastructure development and EU membership drive long-term value creation

- Foreign investment restrictions vary significantly by country and property type

- Professional local guidance remains essential for navigating complex European property markets

- Portfolio diversification across multiple markets optimizes risk-adjusted returns

European real estate continues evolving rapidly, creating new opportunities for astute investors willing to research markets thoroughly and engage qualified local professionals for successful property acquisition and management.